CDR Activity Summary Jan 7, 2026

- Jan 11

- 1 min read

December’s capital raising slowed dramatically, with five small equity-only deals worth roughly $25M-down from $138M across two deals in November. No debt or grant transactions were recorded during the month. Investments skewed heavily toward engineered pathways, including BiCRS, BECCS and marine CDR—reversing November’s nature-only focus.

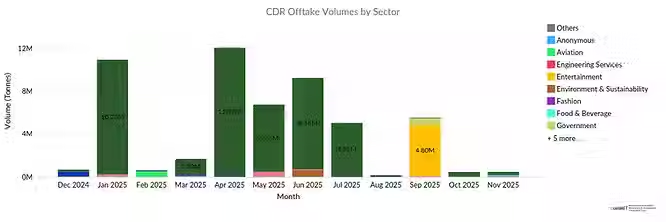

Offtake activity, however, expanded. Six agreements secured around 4.28 Mt of removals; Microsoft’s landmark 3.6 Mt BECCS contract and large biochar deals accounted for most of the volume. Technology-sector purchasers, including Microsoft, Google , comprised roughly 97 % of total volume.

On the credit side, issuances remained muted at about 0.17 Mt, overwhelmingly from Af/Reforestation projects, while retirements rebounded to roughly 0.85 Mt, driven by nature-based solutions such as Af/Reforestation and soil‑based removals. Retirements were more regionally diverse than in previous months, spanning Asia, Africa, South America and North America.

On the project front, Carbon Streaming revised its streaming agreement for the Azuero Reforestation Project in Panama, retaining an option for future funding participation, with first carbon credit issuances expected from 2029 under Verra’s ARR methodology.

ClimeFi Launches Dual-Track RFP for Adyen to Allocate 2025 Climate Budget Across CDR Purchases and Innovation Grants. Deep Sky announced a strategic partnership with Sumitomo Mitsui Banking Corporation to advance direct air capture and carbon dioxide removal deployment in Japan.

.jpg)